In the modern digital-first society, where e-commerce, distant onboarding, and transacting across borders are the new reality, the question of identity verification of an individual has become a need as well as a challenge. Identity fraud and data breach is dangerous, whether it comes to opening a bank account, taking a loan or using digital services. Document verification is important in this. It guarantees that the person submitting an identity document is a real person, the document is legitimate and that businesses can trust to go ahead with customer onboarding or processing of transactions.

The Growing Importance of Document Verification

With the shift of industries to digital activities, the conventional physical identity check processes cannot be possible and effective. Physical checks are not only time consuming but also prone to human error. Conversely, document verification helps companies to verify identities remotely in real-time without having to face each other but with high accuracy and security.

Banks, fintech firms, state agencies, and web platforms are finding this technology very essential in deterring fraud. As cases of identity theft and counterfeiting documents continue to rise, organizations have to ensure that the documents presented by the user like his/her passport, driving license and national identity card are legitimate before they can access their services. This is not only a compliance step, but also a step of developing customer faith and safeguarding sensitive data against cybercriminals.

How Document Verification Works

The current document validation computers integrate improved technologies such as artificial intelligence (AI), optical character recognition (OCR), and machine learning (ML) to examine and validate identity documents. It starts with a user uploading an ID issued by the government or scanning it on boarding. The important information recorded by the software includes name, date of birth, document number and expiration date. It then records this data against known databases or reference templates to verify authenticity.

The AI algorithms can identify minor inconsistencies that the human eye may fail to detect. They conduct security analysis such as holograms, fonts, barcodes, and pattern of microtext. They are also able to determine the image manipulations or changes in the document. Also, a technology of face matching is used to make sure that the selfie sent is matched with the picture on the ID and the owner is the right user of the document.

The outcome is a smooth, precise, and automated verification process that benefits users in addition to minimizing operation costs. Using document verification software, organizations can authenticate hundreds of documents in a few minutes and this means that they can be scaled across international markets.

Document Verification and Regulatory Compliance

In addition to legal and regulatory standards, verification of documents is important to address the issues of security and efficiency. Financial institutions, in particular, should be in line with the Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. These legislations bind businesses to check the identity of the customers to avert illegal practices like money laundering, financing of terrorists, and financial fraud.

Financial bodies, such as the Financial Action Task Force (FATF) and the European Union General Data Protection Regulation (GDPR), have highlighted the role of identity verification and data protection. Within such structures, organizations should be able to manage customer information safely and make sure that the verification processes do not violate the privacy of users. Failure to comply may lead to dire consequences and negative publicity.

In this regard, compliance and innovation can be mediated through documents verification. To a certain degree, by introducing powerful digital document verification systems, the companies not only fulfill the legal requirements but also prove their transparency and interest in the safety of their customers. State of the art solutions enable companies to check documents of various jurisdictions with compliance with local laws on data protection.

The Role of Technology in Modern Verification Systems

The development of artificial intelligence and automation has enabled the growth of document verification software. Verification services based on AI are constantly trained on millions of document sample examples to enhance their accuracy and identify new fraud patterns. Depending on the attempt to use advanced methods of forgery, machine learning models are capable of distinguishing the authentic and the fake ID in a matter of seconds.

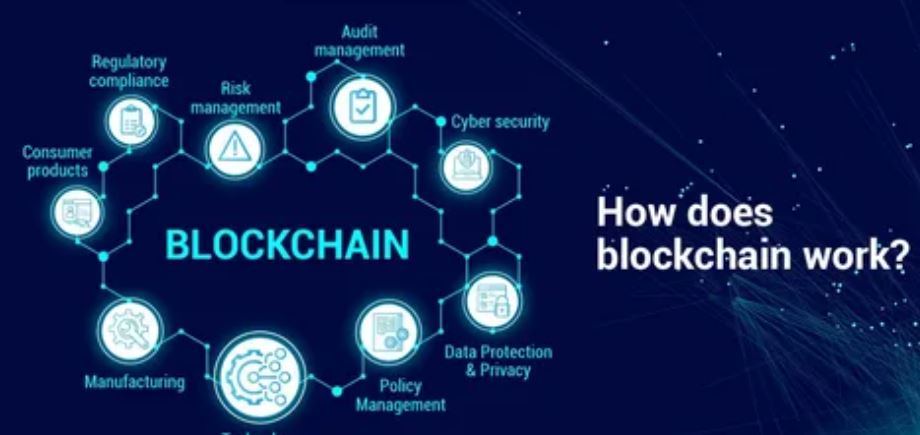

Biometric verification is another technology that is defining the industry. Most document verifications services today include ID check and facial recognition, liveness check, and fingerprinting to provide multi-layered authentication. There is also an increase in the use of the blockchain to develop immutable verification records to increase transparency and traceability.

Verification platforms that are cloud-based make the matter of integration even easier. They enable businesses to integrate verification APIs into their existing systems so that they can immediately onboard without any technical complexity. These solutions are capable of processing various document types across countries, thereby becoming the best solution to organizations across the world who want to have secure and compliant identity management.

Business Impact of Reliable Document Verification

Automated checking of documents also has quantifiable returns on businesses. It simplifies the customer onboarding process, by cutting down the time that would otherwise be spent on manual review, and also removes the bottlenecks in the customer onboarding process which would result in customer drop-offs. The element of a quick and painless verification process leads to the improved user experience and brand loyalty.

Another major benefit is operational efficiency. Automation processes reduce the number of cases compliance departments have to handle by a significant margin, and they can concentrate on other cases that can only be handled through human decision-making. Digital verification is also cost-effective and scalable since the administrative costs decrease because of the reduction in manual work.

In addition, document verification services enable important audit trail to aid regulatory reporting and risk management. Each verification test is logged and time stamped so that when a company is being audited or investigated by the regulatory bodies, it can show that it has complied. Such transparency will not only earn trust amongst the authorities, but also transparency will promote accountability in organizations.

Future of Document Verification

Document verification technologies will keep on advancing alongside cyber threats, which have been shifting. It is predicted that future systems will use more advanced AI frameworks with the ability to comprehend complicated document layouts and identify deep fake identities. Regulatory agencies and governments would also tend to demand uniform verification systems throughout the world to provide equality in the regard to compliance.

As the population becomes more knowledgeable on data privacy, ethical verification will be a point of competitive advantage. By focusing on privacy, transparency, and user consent when verifying their users, companies will be in a better position to acquire customer loyalty. Quantum encryption and decentralized identity systems may be combined to increase document verification security in the future.

Conclusion

Document verification has become an inevitable component of the contemporary digital ecosystems. It protects companies against fraud, stays in line with international regulations and builds consumer confidence. With the growth in the number of online transactions and digital interactions, the need to invest in the trusted document verification software and document verification services is not a luxury anymore.

With the adoption of automation, artificial intelligence, and privacy-friendly approaches, organizations will be able to provide a safe space in which identities will be validated in the quickest and most accurate way. With the digital trust era determining winners, safe and compliant digital interactions are anchored on documents verification.