Cryptocurrency – initially regarded as a stable asset category ready to transform the worldwide financial Framework, has undergone considerable fluctuations in recent times. Although the cryptocurrency market has experienced significant surges – it has also faced drastic declines, causing many to doubt the future of digital currencies. If you are curious about the decline in cryptocurrency prices and if they will bounce back – you are not the only one. This article will examine the reasons behind the recent crashes and provide perspectives on the chances for recovery.

Why is crypto Crashing?

Grasping the reasons’ behind the cryptocurrency market’s crashes necessitates a comprehensive strategy. The factors contributing to the decrease in digital currencies such as bitcoin, Ethereum and others are intricate and include both internal market elements and external influences.

- Regulatory pressure

A major factor leading to the current decline is heightened regulatory oversight globally. Governments’ worldwide are working to control the cryptocurrency sector to prevent unlawful actions like money laundering, fraud and text evasion. These rules – although crucial for ensuring financial stability, have generated uncertainty in the market. Nations’ such as China have taken measures to prohibit cryptocurrency trading, whereas others like the United States and the European Union are enforcing more stringent regulations. The uncertainty of regulations frequently triggers market anxiety, resulting in a decline in prices

- Macroeconomics factors

The wider economic landscape is an additional crucial element influencing cryptocurrency values. During periods of economic instability – times like inflation or global recession, investors frequently look for more secure assets like gold or government bonds. The cryptocurrency market, regarded as a speculative investment, may decline when investors withdraw their money from higher risk assets. The implementation of stricter monetary policies by Central Banks globally, especially the US federal reserve, has resulted in increasing interest rates, which typically reduces investor interest in high risk acid such as cryptocurrencies

- Market sentiment and speculation

Market sentiment and speculation trading often influence cryptocurrencies resulting in significant volatility. When hype or fear prevails in the market – prices may vary dramatically. The growth of social media and influencers intensifies these movements, establishing a cycle that magnifies both the expansion and decline stages. An unexpected adverse news article or a tweet from a prominent individual can cause a significant sell off. The anxiety of being left out (FOMO) in bullish trends and fear during bearish conditions can cause significant volatility

- Security concerns and hacks

Security incidents and hacks have additionally led to the volatility in the cryptocurrency market. Prominent events, like the Mt. The Gox hack in 2014 and subsequent breaches have diminished investor trust. Although blockchain technology is frequently hailed as secure – cryptocurrency exchanges and wallets’ remain vulnerable to cyberattacks. A major hack or theft can trigger a steep drop in cryptocurrency values as investors become concerned about the security of their assets.

- Liquidity issues and whale activity

An additional crucial aspect is market liquidity, impacted by “whale” activity – major investors who possess considerable quantities of a specific cryptocurrency. When whales choose to offload their assets, it can lead to significant price declines. Moreover, smaller investors might become anxious and imitate this behaviour, worsening the decline. Liquidity challenges further complicate the ability of smaller investors to enter or exit the market, resulting in price manipulation by larger entities

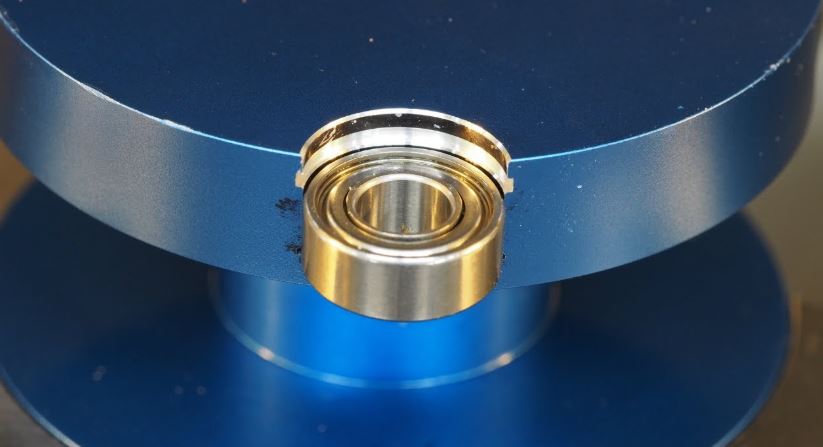

- Technology challenges and network issues

Although blockchain technology offers numerous benefits – cryptocurrencies continue to encounter technical challenges that may impact their worth. Challenges such as scalability problems, elevated transaction costs and sluggish processing speeds for specific networks may dissuade prospective investors. For example – Ethereum – the second biggest cryptocurrency has struggled with managing a high volume of transactions, resulting in increased processing times and costs – impacting its market image.

Will crypto recover?

Although the present downturn in the cryptocurrency market has raised considerable alarm, historical trends’ indicate that the digital asset sector might have the potential to bounce back. Here’s the reason:

- Historical resilience

Cryptocurrencies – especially bitcoin, have traditionally recovered from downturns. The initial significant crash happened in 2011, succeeded by a bigger drop in 2013, but bitcoin and various altcoins managed to bounce back on both occasions. The cryptocurrency market has experienced comparable volatility periods, and even with substantial price declines, the long term trend has remained positive

- Institutional adoption

The rising acceptance of cryptocurrencies by institutional investors is yet another element that could promote future recovery. Major financial entities such as Paypal, Tesla and conventional investment companies like Fidelity and Grayscale have started to adopt cryptocurrency. Such investments provide a degree of stability and credibility to the market – potentially reducing the effects of market downturns. The influx of institutional capital into the sector may result in price stabilization and reduced volatility

- Technology innovation

Blockchain technology is advancing quickly and fresh innovations keep appearing that may improve the capabilities and scalability of cryptocurrencies. For instance, Ethereum 2.0, designed to shift from proof of work to proof of stake – guarantees enhancements in transaction velocity and energy efficiency. Such enhancements might render crypto assets’ more appealing to both users and investors, contributing to a reduction in the volatility that defines the current market.

- Growing use cases

Aside from speculation, cryptocurrencies are progressively utilised for real white purposes, including remittances, decentralized finance (DeFi), non fungible tokens (NFTs), and additional applications as these applications. As these applications grow – the need for cryptocurrencies might rise, bolstering their worth in the long run. Cryptocurrencies are also being investigated as a substitute for conventional banking, particularly in areas with volatile financial systems. The expansion of decentralized applications (dApps) may also stimulate novel use cases, increasing the market’s robustness

- Global inflation hedge

As inflation rate increases globally, numerous investors see cryptocurrencies, particularly bitcoin, as a safeguard against the decline of fiat currency value. The idea of bitcoin being “digital gold” is becoming popular as an increasing number of individuals seek to diversify their investments. With the growing number of investors fleeting depreciating traditional assets, the demand for cryptocurrencies could rise, accelerating their rebound

Conclusion

The Cryptocurrency market is certainly unstable and recent downturns highlight the dangers associated with investments in digital assets’. Nonetheless, the elements causing the decline including regulatory ambiguity, market sentiment, and microeconomic factors, are not inherently lasting. With institutional acceptance, continuous continuous Technological progress, and the possibility of more practical applications, cryptocurrencies could rebound overtime

For investors – the crucial aspect is grasping the fundamental elements influencing crypto prices and making choices based on long term prospects instead of temporary market fluctuations. Although the path to recovery can be challenging – history demonstrates that the crypto market possesses’ an extraordinary capacity to bounce back from declines. Nonetheless, it’s crucial to approach cryptocurrency investments’ carefully and conduct extensive research, as fluctuations are expected to persist as a norm in the upcoming period